One thing social media will bring to your attention immediately is constant arguments about the market bottom. You will see all sorts of opinions. “The S&P 500 has to go way lower; “Don’t buy here, wait for the bottom”; “I’m going to cash because this will get much worse”; “Im waiting for the market to recover before buying more stocks”. Everyone truly believes they have a magic wand and a crystal ball. Guess what? They don’t.

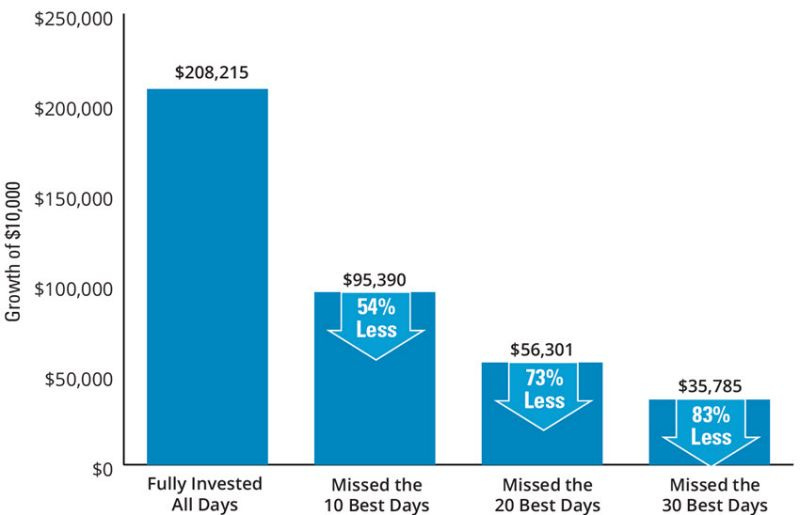

History and data prove that timing the market is not only a bad idea, it’s also nearly impossible. According to Bank of America, if you look at data going back to 1930, if an investor sat out of the S&P 500’s ten best days for each decade, total returns would significantly underperform an investor who waited it out. In fact, the market sees its best performing days following the largest drops, which verifies that panic selling leads to missed opportunities to the upside.

Skeptical? Let’s look at the numbers. If we look at that same data going back to 1930, if you missed the S&P 500s ten best days for each decade, the total return would only be 28%. Not great! But if you held and rode the waves up and down and didn’t panic sell, those returns would have been a whopping 17,715%!

The above charts are powerful, and they provide some comfort to long-term investors who are constantly being told they are wrong. The reality is most noise that you hear is from traders, not investors. These are two completely different mindsets. In fact, if you are having an argument with a trader on the difference between the two, realize you are wasting your breath 90% of the time.

But some of you are now scratching your heads and thinking, “what the hell is the actual difference and how do you define it”? I’ve got you. Trading involves short-term strategies to maximize returns daily, monthly, or quarterly, generally focused more on technicals or momentum and not fundamentals. Investing is a strategy geared towards managing and growing wealth over the long term with fundamentals as a priority. These mindsets are like oil and water.

So what should you do in a bear market? How should you buy stocks? Time the bottom? Buy periodically? If you would like to watch a 6-minute video of me explaining how I do it, you can watch that here:

In a nutshell, I use dollar-cost averaging (DCA) to buy my highest conviction stocks at levels. That conviction comes from countless hours of due diligence (DD), which is what we call fundamental analysis. Fundamental analysis combines quantitative and qualitative analysis. If you are interested in learning more about this and investing from A-Z, check out my Masterclass series, which is 11.5 hours of my best content: Investing From A-Z

Back to my DCA approach. I use technical analysis to buy my highest conviction stocks at levels. In a bear market, I stay disciplined not to buy more until it reaches my next target level. This has proven to be a useful tool, in my experience. If you aren’t familiar, I started investing in the late 1990s, and I have learned many lessons the hard way. Using the DCA combined with technical analysis approach has pros and cons, but it works best for me. I always share my experience and opinions and tell you to do what’s best for you. After all, it’s your money. 😃

Thanks for reading! Have a nice weekend. If you are looking for more stock market content this weekend, I encourage you to watch this latest 2+ hour video with @BluSuitDillon:

2 things cannot be proven wrong: history & numbers. And that's just what you share here.

Sometimes fear and cutting losses will make you miss out on good stocks. The best way is to avoid the noise in the market and focus on the fundamentals.