Of course, there are many ways a person can create wealth. Most circumstances require hard work and lots of time. The simplest wealth generation tool of all time is still the stock market, and I believe it will be for my lifetime and many years beyond. Yes, real estate can also generate wealth, but it requires way more work than the stock market. Today, let’s focus on stocks.

I started investing in the late 1990s. I was a college student, and I had no idea what I was doing. You have probably heard the story before, but my first stock went to zero in a matter of months. I didn’t do any homework on the company. I heard about it from another guy, and it sounded like a cool story. It was a biotech company. Highly speculative. A penny stock.

Of course, not doing my due diligence was a huge mistake. The other mistake I made is that I went all in. I didn’t have a plan. I didn’t diversify. I didn’t dollar-cost average. In fact, I didn’t even know what any of these things were at the time.

This experience motivated me to learn. I began reading every book I could and spending thousands of dollars on courses and mentorship programs from seasoned investors. Some of this was highly valuable, while much of it was a waste of money. With time, I took information from various resources and created my own methodology and plan that worked best for me.

Fast forward to 2022, and I’ve been through the Dot-Com Bubble, The Great Recession, the Covid-19 pandemic crash, this year’s dumpster fire, and everything in between. Here are some of the lessons learned.

First, social media has made long-term investing severely challenging. While there are many benefits of technology, the downside is that you have information at your fingertips, and too much of it. Analysis paralysis is a real issue in today’s environment. You get overloaded with contradicting news and information daily. It’s nearly impossible to navigate. On top of all of this, the majority of what you hear and see is thinking from a short-term perspective. 90% or more of the info you are seeing is focused on 6 months and not 6 years. Oh, and don’t forget that all of the talking heads have agendas. Whether it’s Bill Ackman coming on CNBC in March of 2020 telling you “hell is coming” while being short the market, or if it’s a YouTuber being paid to pump a stock, you have to be aware of agendas.

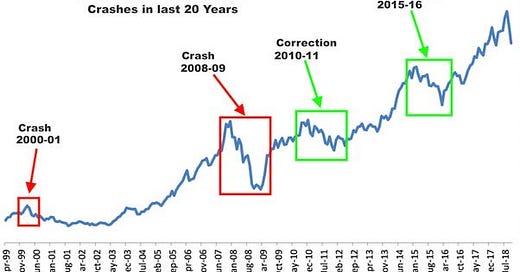

Take a look at the chart above. If I showed you this chart and told you that you could simply invest in the stock market and have your money generate wealth over time, would you do it? It seems so simple, right? Then why doesn’t everyone do it? There are many reasons, but the primary reason is the psychology behind it. We are wired to want to be right. Think about this for a second. Remember in 2021 when you bought a stock and it went up 10% the next day? Whether you realized it or not, you were getting a dopamine rush from this. A natural feel-good high awarded by your brain instinctively, which wants to be right every time.

The flip side to this can be disastrous, because the emotion you feel from pain is much greater than the dopamine high you received on the other side. That’s right, we are born wired to punish ourselves. Loss aversion in behavioral economics refers to a phenomenon where a real or potential loss is perceived by individuals as psychologically or emotionally more severe than an equivalent gain. For example, the pain of losing $1,000 is often far greater than the joy received in finding the same amount. Understanding this helps you be a better investor.

We could go down a rabbit hole just in this topic. Our egos are also part of the equation as well as topics such as the overconfidence effect. Lots of this is covered on the masterclass videos, so make sure to watch those.

Back to my lessons learned over 20 years in the stock market. We already discussed due diligence from a high level. This is critical for individual stock pickers. You have to put in the time. Do your homework. Without it, you will lack conviction, and it will be impossible to overcome the psychology behind FOLE (fear of losing everything). If you have conviction, you will probably buy more when it’s down. When you lack conviction, you will buy high and sell low, just like I did when I first started investing.

This leads me to dollar-cost-averaging. You will see it called DCA. This is important, so please keep reading. There are two types of FUW DCA. Periodic, which is buying the same equities every paycheck. For example, you buy $500 in VOO every paycheck. The second type of DCA is much more complicated. The FUW methodology of DCA is unique because it involves the use of technical analysis to buy levels. You will hear people taking about DCA, but there’s usually no strategy behind it. If you understand the company and are disciplined with building positions, your success rate will be much higher. We teach this every day in Discord.

Another topic I’d like to cover is timing the bottom. You can’t time the bottom. Don’t try to. Timing the bottom is a fool’s game. The people saying “the market has to do XYZ” have no idea. They are usually pushing a personal agenda. Many times these people never buy regardless of how low it goes. This goes back to why social media can be a huge problem. It can be difficult to drown out the noise. This is why we created the private Discord community. Birds of a feather flock together, and surrounding yourself with like-minded people is crucial.

Dollar-cost-averaging works. Look at the chart above again. If you bought the previous bear markets, the timing didn’t matter all that much. The reason it feels so important leads us back to psychology. You feel like you have to time the bottom and be right. You hate buying a stock and seeing it go lower the next day. But if you understand all the things we are discussing today, it helps you realize that it’s not going to matter much in the long run, assuming you are buying the right stocks.

I discuss these topics and much more in the masterclass videos. There are a total of 13 videos and 12 hours of content available on Patreon. I encourage you to check those out. I created these videos with the intent of teaching my 20-year-old self what to do in the late 1990s. The masterclass series, if I had the info back then, would have saved me thousands of dollars and tons of time and effort. I truly believe I would have millions more in the bank if it hadn’t taken me so long to figure it all out.

What does FIRED stand for in FIRED Up Wealth? FIRED (Financial Independence Retire Early w/Dividends) Up Wealth was created for long-term investors focused on growth to accumulate wealth, then passive income to achieve financial freedom. It’s a unique methodology that combines growth investing with FIRE. If you are interested in learning about individual stocks, long-term investing, financial independence, personal finance, psychology of money, and more….check us out below. We are the best investing community on the planet, and we are just getting started!

Enjoy your weekend! -Eric